Agricultural market – instability of fluctuating grain prices

Ultimately, marketing the crop yield gives some indication from the economic viewpoint as to how successful the crop has been. The production management site focuses on economically viable business activity and good risk management with respect to suitable marketing strategies. For this purpose the individual factors, such as storage capacity and weather conditions must be taken into account. Selling at the right moment is crucial, for grain prices are determined not solely by domestic factors, but are subject to constant fluctuations in price, which are influenced by global market factors. Therefore, the situation on both the domestic and the international markets must be considered, in order to maximise earnings.

Estimates of international cereal production and harvests for 2020

There is a variety of Smart Farming solutions, such as Smartphone apps available to assist in watching the agricultural markets and grain prices. For example, it is possible to install an alarm, which sounds if grain prices on the Paris futures market ((Marché de Terme International de France MATIF) are exceeded or fall short. In addition, it is now even possible to sell cereals by means of a variety of apps. Nevertheless the question remains, what crop yield should be expected and how are market prices developing. The last few years of drought have left hardly any fodder reserves, which means that high crop yields are desirable, all the more so since, for instance, the global requirement for wheat has increased slightly. This has been caused by increased use of fodder in Russia and higher consumption in Pakistan and the EU as a foodstuff, seeds and cereal for industrial use.

Wheat: Because, just as in the previous years, it has been too dry in Germany in 2020, wheat crop yields have on average, with regional fluctuations, been poor. Conversely, in the EU common wheat production fell short of the forecasts. In particular the significantly lower yields in France are responsible for this, together with the poorer harvests in Romania and Bulgaria. On the other hand, a large Russian wheat harvest was expected.

Maize: Because of the high rainfall the maize had to be harvested early in Germany, which reduced yields. At the same time it was too warm in France, Germany and Romania, which likewise led to reduced crop yields.

Barley: The barley harvest in 2020 is at the same level as in the previous year. In this case lower yields were forecast, since the yields in France were lower.

Oats: Despite unfavourable growing conditions the oat harvest, the measurement of which took account of the increase in arable land, shows an upward trend.

Rapeseed: Due to higher yields in Germany, Poland and Lithuania as compared to the previous year the rapeseed harvest for 2020 is estimated as slightly higher. Here the picture is regarded as a whole and there are regional fluctuations depending on local cultivation conditions.

Image by Couleur on Pixabay

Development of grain prices on the agricultural market: international grain trade

The prices for cereals and oilseed are once more on a rising trend both in the USA and in Europe. A glance at Chicago (Chicago Board of Trade CBOT) shows increasing grain prices, in particular for wheat and maize. The same can be seen on the futures market in Paris. Price forecasts are currently facing the challenge of taking into account the uncertainties from the dry weather conditions in South America and Russia, as well as the high demand for cereals from China. To this are added the reduction in agricultural land and reduced cereal and oilseed crop yields, for which the forecasts, especially in the USA do not match the actual harvest and growing situation. However, some of the forecasts are very speculative. For instance, the International Grains Council (IGC) assumes a lower maize harvest, In this process sowing was not begun until September in South America and this is already affecting not only the futures markets in Chicago, but also all the other futures markets.

How long can prices remain at this high level and when is it the right time to sell? No-one can answer this question with certainty. In this case it is necessary to watch the markets and as far as possible to react quickly. With the uncertainty as to whether prices will continue to remain so high or whether they will even rise higher, trade is currently levelling off. Many farmers are in a sort of waiting position, watching to see if and how the market is changing, but this also has effects on the markets and can lead to a slump. However, should the crop yields fall lower than forecast by the analysts, the grain prices would possibly increase further.

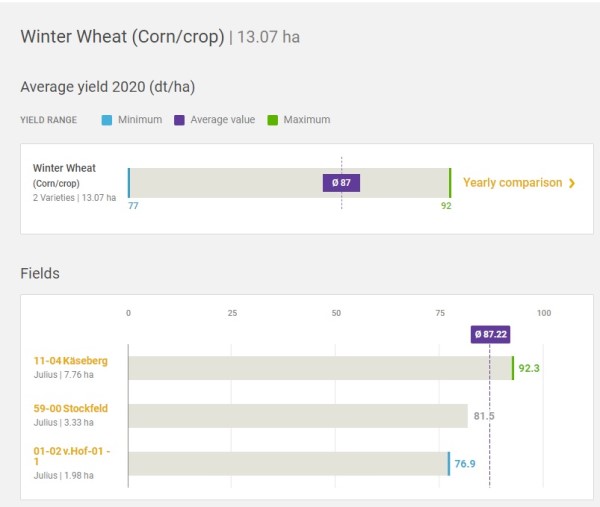

Appropriate applications of 365FarmNet